Acully strives to answer your questions with experience and expertise

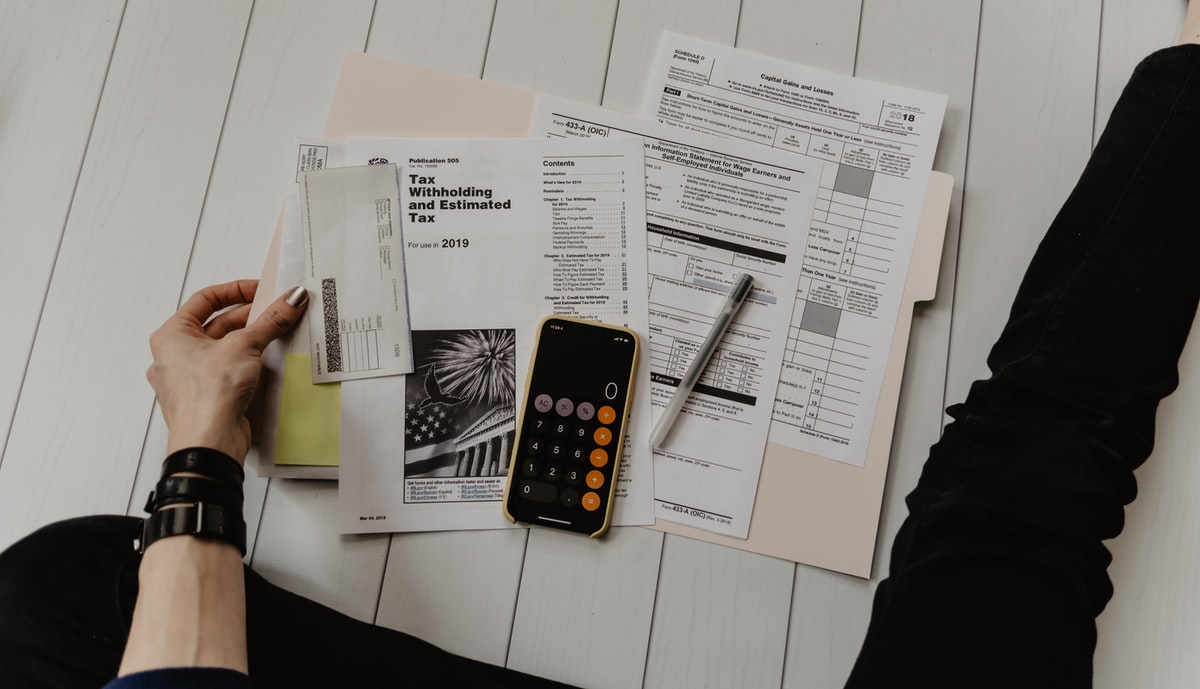

Form 1040 & Related Filings

Complete federal and state tax return preparation with all required schedules

Strategic Tax Planning

Customized planning to optimize taxes across income, entities, and borders

What you can expect

Related Questions and Information

Company INFOrmation

Acully Incorporated is a Certified Public Accounting firm licensed in The State of Ohio serving all 50 states and the global community.

Phone and Text 1-216-223-8623

Fax 1-440-545-7550

US – Concord, OH

EU – Trieste, Italy

Address and Additional Information

Legal

©2024-25 Acully Incorporated. World rights reserved.

US Tax Team, Acully, MyStartup.US and DocuTraker are tradenames of John M Matras CPA Incorporated or its affiliates.